Is Depreciation Part Of Overhead . learn what overhead costs are and how they are allocated to cost objects in cost accounting. the company simply add depreciation to the total overhead cost and allocate base on the unit produce during the period. overhead is the cost of running a business that is not directly related to producing a product or service. while depreciation refers to the gradual decrease in the value of an asset over time, overhead costs encompass all. Learn about the different types. Depreciation is one of the overhead costs that needs to be distributed over the period. in the production department of a manufacturing company, depreciation expense is considered an indirect cost,. It is classified as an overhead cost.

from efinancemanagement.com

Learn about the different types. in the production department of a manufacturing company, depreciation expense is considered an indirect cost,. It is classified as an overhead cost. the company simply add depreciation to the total overhead cost and allocate base on the unit produce during the period. learn what overhead costs are and how they are allocated to cost objects in cost accounting. overhead is the cost of running a business that is not directly related to producing a product or service. Depreciation is one of the overhead costs that needs to be distributed over the period. while depreciation refers to the gradual decrease in the value of an asset over time, overhead costs encompass all.

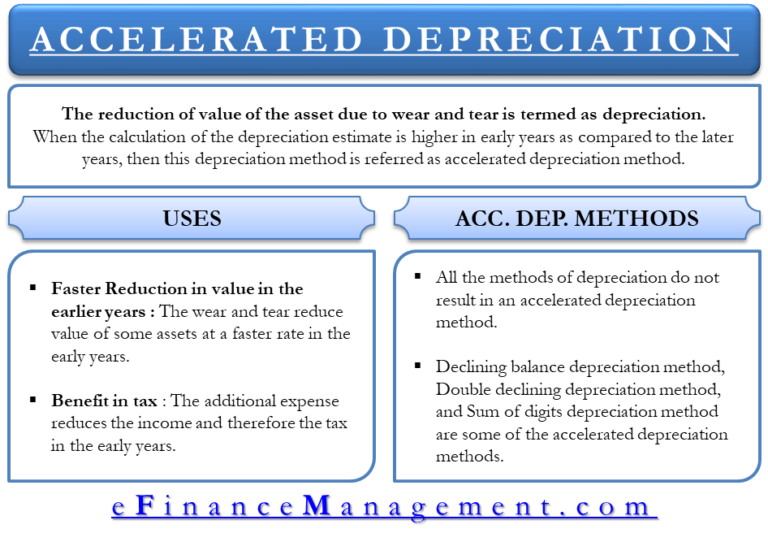

Accelerated Depreciation Method eFinanceManagement

Is Depreciation Part Of Overhead It is classified as an overhead cost. learn what overhead costs are and how they are allocated to cost objects in cost accounting. Learn about the different types. It is classified as an overhead cost. Depreciation is one of the overhead costs that needs to be distributed over the period. the company simply add depreciation to the total overhead cost and allocate base on the unit produce during the period. overhead is the cost of running a business that is not directly related to producing a product or service. in the production department of a manufacturing company, depreciation expense is considered an indirect cost,. while depreciation refers to the gradual decrease in the value of an asset over time, overhead costs encompass all.

From www.studocu.com

Depreciation Methods n/a What are the Main Types of Depreciation Is Depreciation Part Of Overhead Depreciation is one of the overhead costs that needs to be distributed over the period. in the production department of a manufacturing company, depreciation expense is considered an indirect cost,. the company simply add depreciation to the total overhead cost and allocate base on the unit produce during the period. while depreciation refers to the gradual decrease. Is Depreciation Part Of Overhead.

From www.online-accounting.net

Straight Line Depreciation Method Online Accounting Is Depreciation Part Of Overhead Learn about the different types. It is classified as an overhead cost. in the production department of a manufacturing company, depreciation expense is considered an indirect cost,. learn what overhead costs are and how they are allocated to cost objects in cost accounting. Depreciation is one of the overhead costs that needs to be distributed over the period.. Is Depreciation Part Of Overhead.

From exotoprsi.blob.core.windows.net

Manufacturing Overhead Definition at Stacey McDowell blog Is Depreciation Part Of Overhead overhead is the cost of running a business that is not directly related to producing a product or service. Learn about the different types. It is classified as an overhead cost. the company simply add depreciation to the total overhead cost and allocate base on the unit produce during the period. Depreciation is one of the overhead costs. Is Depreciation Part Of Overhead.

From online-accounting.net

Accounting For Actual And Applied Overhead Online Accounting Is Depreciation Part Of Overhead overhead is the cost of running a business that is not directly related to producing a product or service. the company simply add depreciation to the total overhead cost and allocate base on the unit produce during the period. It is classified as an overhead cost. Depreciation is one of the overhead costs that needs to be distributed. Is Depreciation Part Of Overhead.

From exobehtve.blob.core.windows.net

The Journal Entry To Record Depreciation Expense For A Piece Of Is Depreciation Part Of Overhead learn what overhead costs are and how they are allocated to cost objects in cost accounting. the company simply add depreciation to the total overhead cost and allocate base on the unit produce during the period. Learn about the different types. overhead is the cost of running a business that is not directly related to producing a. Is Depreciation Part Of Overhead.

From efinancemanagement.com

Accelerated Depreciation Method eFinanceManagement Is Depreciation Part Of Overhead overhead is the cost of running a business that is not directly related to producing a product or service. Depreciation is one of the overhead costs that needs to be distributed over the period. learn what overhead costs are and how they are allocated to cost objects in cost accounting. in the production department of a manufacturing. Is Depreciation Part Of Overhead.

From gstguntur.com

What is Depreciation? Definition, Working, Formula, Calculation GST Is Depreciation Part Of Overhead Depreciation is one of the overhead costs that needs to be distributed over the period. overhead is the cost of running a business that is not directly related to producing a product or service. the company simply add depreciation to the total overhead cost and allocate base on the unit produce during the period. learn what overhead. Is Depreciation Part Of Overhead.

From studylib.net

Depreciation Is Depreciation Part Of Overhead the company simply add depreciation to the total overhead cost and allocate base on the unit produce during the period. in the production department of a manufacturing company, depreciation expense is considered an indirect cost,. It is classified as an overhead cost. while depreciation refers to the gradual decrease in the value of an asset over time,. Is Depreciation Part Of Overhead.

From moneysmint.com

What Is Depreciation? Definition, Types, Example & Purpose Is Depreciation Part Of Overhead the company simply add depreciation to the total overhead cost and allocate base on the unit produce during the period. It is classified as an overhead cost. overhead is the cost of running a business that is not directly related to producing a product or service. learn what overhead costs are and how they are allocated to. Is Depreciation Part Of Overhead.

From www.slideshare.net

Depreciation Is Depreciation Part Of Overhead Learn about the different types. It is classified as an overhead cost. in the production department of a manufacturing company, depreciation expense is considered an indirect cost,. overhead is the cost of running a business that is not directly related to producing a product or service. Depreciation is one of the overhead costs that needs to be distributed. Is Depreciation Part Of Overhead.

From financestu.com

Relationship between CapEx and Depreciation (Terminal Value) Is Depreciation Part Of Overhead while depreciation refers to the gradual decrease in the value of an asset over time, overhead costs encompass all. the company simply add depreciation to the total overhead cost and allocate base on the unit produce during the period. learn what overhead costs are and how they are allocated to cost objects in cost accounting. Depreciation is. Is Depreciation Part Of Overhead.

From www.scribd.com

Overhead DP PDF Expense Depreciation Is Depreciation Part Of Overhead while depreciation refers to the gradual decrease in the value of an asset over time, overhead costs encompass all. Depreciation is one of the overhead costs that needs to be distributed over the period. learn what overhead costs are and how they are allocated to cost objects in cost accounting. in the production department of a manufacturing. Is Depreciation Part Of Overhead.

From www.excel-pmt.com

How to Calculate Depreciation Methods Project Management Small Is Depreciation Part Of Overhead while depreciation refers to the gradual decrease in the value of an asset over time, overhead costs encompass all. overhead is the cost of running a business that is not directly related to producing a product or service. the company simply add depreciation to the total overhead cost and allocate base on the unit produce during the. Is Depreciation Part Of Overhead.

From differencess.com

Accumulated Depreciation Vs Depreciation Expense What's The Difference Is Depreciation Part Of Overhead overhead is the cost of running a business that is not directly related to producing a product or service. Learn about the different types. Depreciation is one of the overhead costs that needs to be distributed over the period. learn what overhead costs are and how they are allocated to cost objects in cost accounting. in the. Is Depreciation Part Of Overhead.

From www.scribd.com

Calculating Overhead Rates for Production Departments PDF Is Depreciation Part Of Overhead It is classified as an overhead cost. Learn about the different types. Depreciation is one of the overhead costs that needs to be distributed over the period. overhead is the cost of running a business that is not directly related to producing a product or service. the company simply add depreciation to the total overhead cost and allocate. Is Depreciation Part Of Overhead.

From www.studocu.com

Adjustments Depreciation THE CONCEPT OF DEPRECIATION • Part of the Is Depreciation Part Of Overhead It is classified as an overhead cost. overhead is the cost of running a business that is not directly related to producing a product or service. Depreciation is one of the overhead costs that needs to be distributed over the period. while depreciation refers to the gradual decrease in the value of an asset over time, overhead costs. Is Depreciation Part Of Overhead.

From exodmwchw.blob.core.windows.net

Why Is Tax Depreciation Different From Book Depreciation at Derek Is Depreciation Part Of Overhead the company simply add depreciation to the total overhead cost and allocate base on the unit produce during the period. Learn about the different types. It is classified as an overhead cost. in the production department of a manufacturing company, depreciation expense is considered an indirect cost,. while depreciation refers to the gradual decrease in the value. Is Depreciation Part Of Overhead.

From www.youtube.com

What to do with Depreciation on the Statement of Cash Flows YouTube Is Depreciation Part Of Overhead learn what overhead costs are and how they are allocated to cost objects in cost accounting. the company simply add depreciation to the total overhead cost and allocate base on the unit produce during the period. Depreciation is one of the overhead costs that needs to be distributed over the period. while depreciation refers to the gradual. Is Depreciation Part Of Overhead.